What You Need to Know about Business Car Insurance

Are you a business owner who uses a car for business purposes? Whether it’s delivering products to clients, visiting potential customers, or simply commuting to work, using a car for business activities is common. However, did you know that personal auto insurance may not cover you if an accident occurs while conducting business activities? This is where business car insurance comes in. In this article, we will explore what you need to know about business car insurance to protect yourself, your employees, and your business.

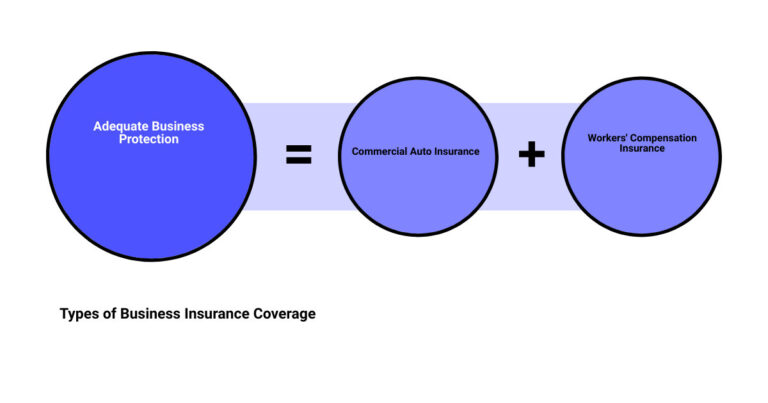

Types of Business Car Insurance

There are three main types of business car insurance: commercial auto insurance, hired and non-owned auto insurance, and personal auto insurance.

1. Commercial Auto Insurance

Commercial auto insurance is a type of insurance coverage that provides protection for vehicles that are used primarily for business purposes. This type of insurance is typically more expensive than personal auto insurance because it provides a higher level of coverage. It covers liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

This type of insurance is essential for businesses that use a fleet of vehicles to conduct daily operations. It provides protection for the business owner, employees, and the vehicles themselves. If an accident occurs, commercial auto insurance will cover the cost of damages and injuries, protecting the business from financial losses.

2. Hired and Non-Owned Auto Insurance

Hired and non-owned auto insurance is a type of insurance coverage that provides protection for vehicles that are not owned by the business but are used for business purposes. This type of car insurance is typically purchased by businesses that rent or lease vehicles or have employees who use their personal vehicles for business purposes. It covers liability, collision, and comprehensive coverage.

This type of insurance is essential for businesses that allow employees to use their personal vehicles for business purposes. It provides protection for the business owner and the employee in case of an accident. If an accident occurs, hired and non-owned auto insurance will cover the cost of damages and injuries, protecting the business from financial losses.

3. Personal Auto Insurance

Personal auto insurance is a type of insurance coverage that provides protection for vehicles that are used for personal purposes. If you use your personal vehicle for business purposes, you may need to add a commercial use endorsement to your policy. This endorsement will provide coverage for business-related activities.

Factors That Affect Business Car Insurance Rates

Several factors affect the cost of business car insurance. These include:

1. Vehicle Type

The type of vehicle you use for business purposes will impact your insurance rates. Typically, larger vehicles, such as trucks or buses, will have higher insurance rates than smaller vehicles, such as cars or vans.

2. Driving Record

Your driving record will also impact your insurance rates. If you have a clean driving record, you’ll likely pay less for insurance than someone who has a history of accidents or traffic violations.

3. Business Location

Your business location can also impact your insurance rates. If you operate in an area with a high crime rate or a lot of accidents, you may pay more for insurance.

4. Business Use

The type of business you operate and the frequency of use of your vehicle will also impact your insurance rates. For example, a business that requires frequent travel will likely pay more for insurance than a business that only uses a vehicle occasionally.

Final Thoughts

If you use a car for business purposes, it’s important to have the right type of insurance coverage. Business car insurance provides coverage for vehicles that are used for business purposes and is essential for protecting your business, employees, and vehicles. When choosing a policy, it’s important to consider the type of coverage you need, your driving record, the location of your business, and the frequency of use of your vehicle. By taking the time to research your options and choose the right policy, you can ensure that you have the coverage you need to protect your business and its assets.

Get the right business car insurance for your needs with the help of Jeffrey Wangen Insurance Agency. We offer customized insurance solutions tailored to each individual business’s unique needs and requirements. Our team of experienced professionals is knowledgeable in the field of commercial auto insurance and can provide expert advice on coverage options and pricing. Get a quote now!